what is a deferred tax provision

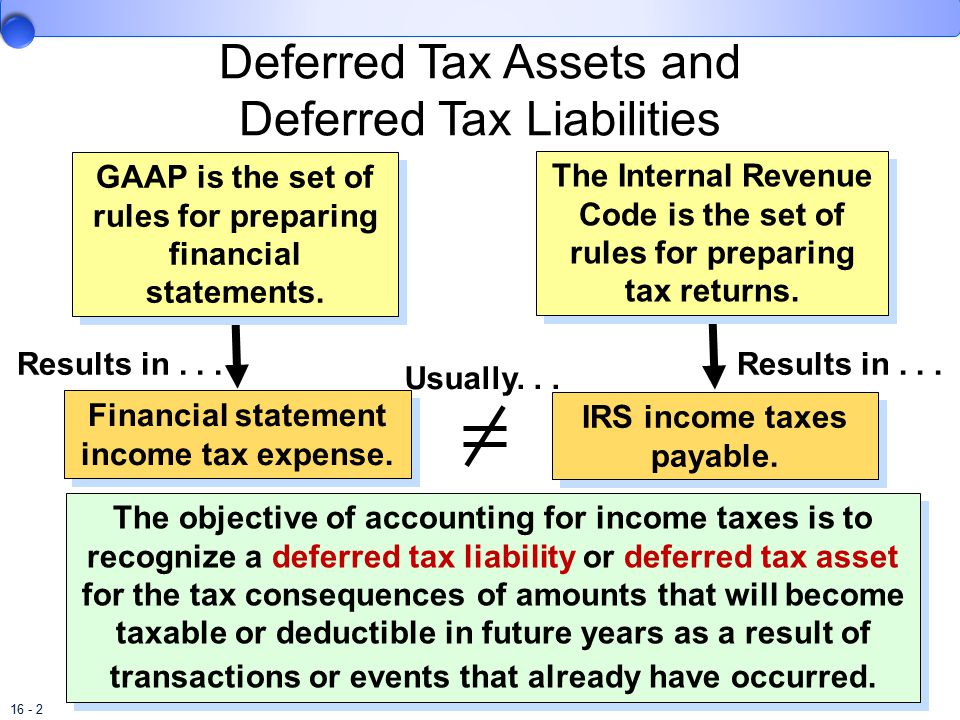

The deferred income tax is a liability that the company has on its balance sheet but that is not due for payment yet. Deferred income tax is a result of the difference in income recognition between tax laws ie the IRS and accounting methods ie GAAP.

Deferred Tax Asset Deferred Tax Liability Financial Statement Reporting On B S I S Youtube

Deferred income tax expense is the.

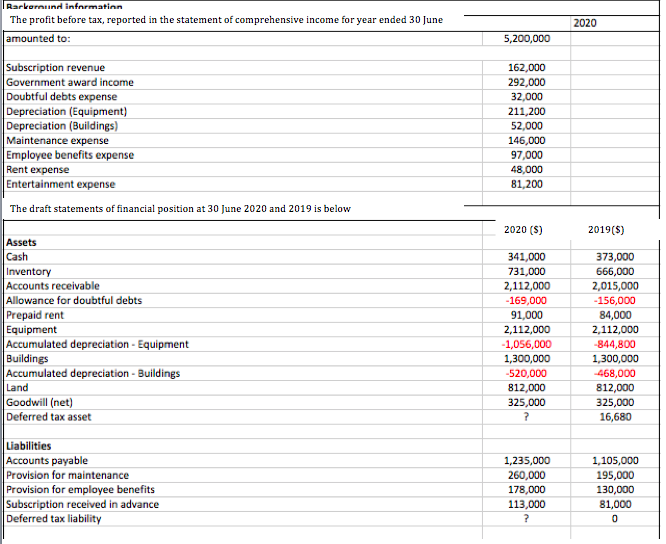

. Deferred taxes are not recognised under the Income Tax Act 1961. The deferred tax provision is there to smooth the timing difference so in our example above the deferred tax provision would be 2850 22800 - 19950. Four key tax provision areas that could be affected by COVID-19.

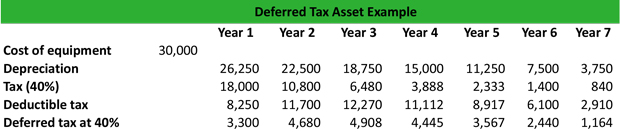

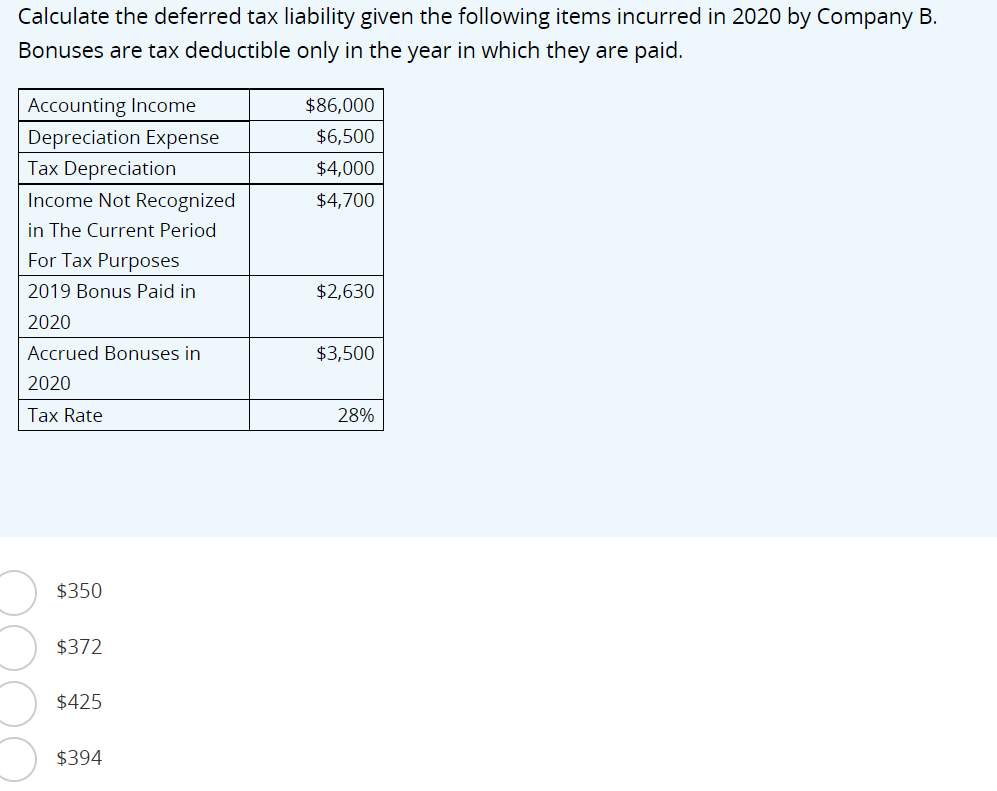

As the taxable temporary differences give rise to. This more complicated part of the income tax provision. Calculate deferred tax asset or deferred tax liability.

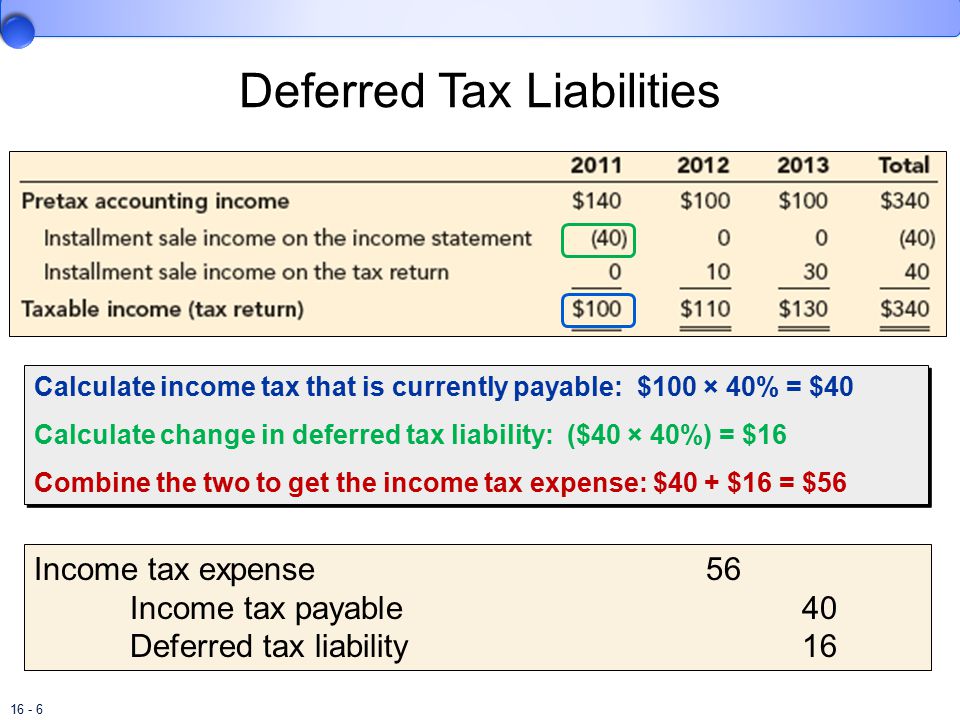

Start with pretax GAAP income. However they are important for accounting purposes. Deferred tax liabilities are the amounts of income taxes payable in future periods in respect of taxable temporary differences.

A deferred tax liability occurs when a business has a certain amount of income for an accounting period and that amount is different from the taxable amount on their tax return. A deferred tax asset is a balance. What is provision for a deferred tax.

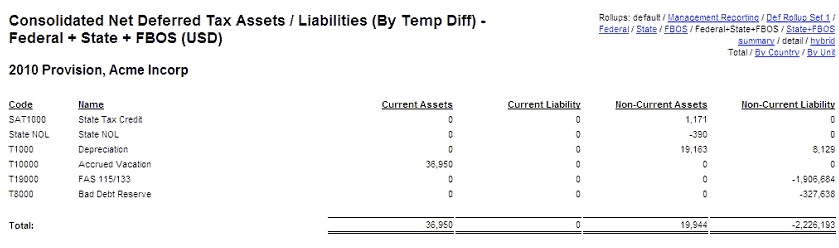

In the last column of the table ABC can calculate its deferred tax asset or liability. Deferred income tax shows up as. Recognition of deferred tax assets Deferred tax liabilities associated with investment in subsidiaries Expected.

The deferred income tax expense refers to a cost thats noted as a liability on your balance sheet but doesnt have to be paid just yet. If deferred tax provision in not recognized then Profit and loss Account would look like as follows. Deferred income tax is a balance sheet item that can either be a liability or an asset as it is a difference resulting from the recognition of income between the accounting records of the.

Add or subtract the net change in temporary. To estimate the current income tax provision. If the tax rate is 30 the Company will make a deferred tax asset journal entry Deferred Tax Asset Journal Entry The excess tax paid is known as deferred tax asset and its journal entry is.

When a company pays its tax liability in advance or reduces its tax liability for a subsequent year then it is known as a Deferred Tax Asset. Now see that if deferred tax is not recognized provision for taxation isfluctuating. Timing differences are the differences between taxable income and accounting income for a period that originate in one.

- Quora Answer 1 of 2. Deferred tax is the tax effect of timing differences. Lets look at an example.

Add or subtract net permanent differences. A provision is created when deferred tax is charged to the profit and loss account and this provision is reduced as the timing difference reduces.

Deferred Income Tax Liabilities Explained With Real Life Example In A 10 K

Tax Base Of Assets Definition Examples Analyst Answers

Accounting For Income Taxes Ppt Download

Recognising Deferred Tax On Leases Kpmg Global

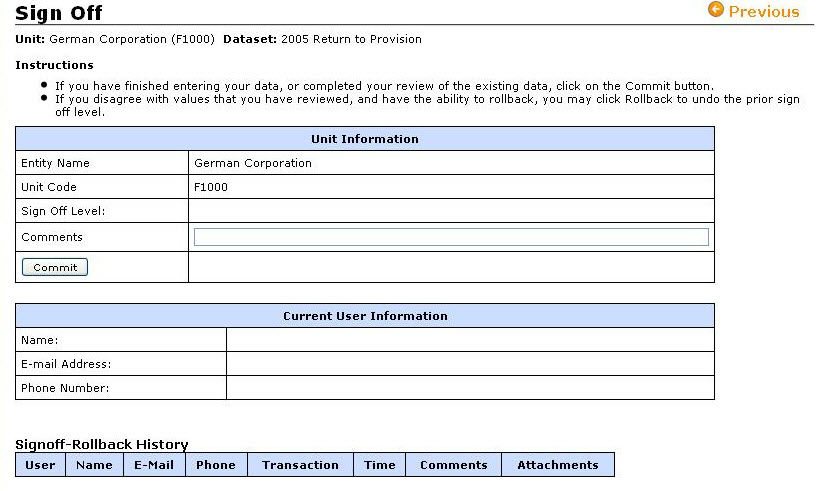

Onesource Tax Provision V2014 1

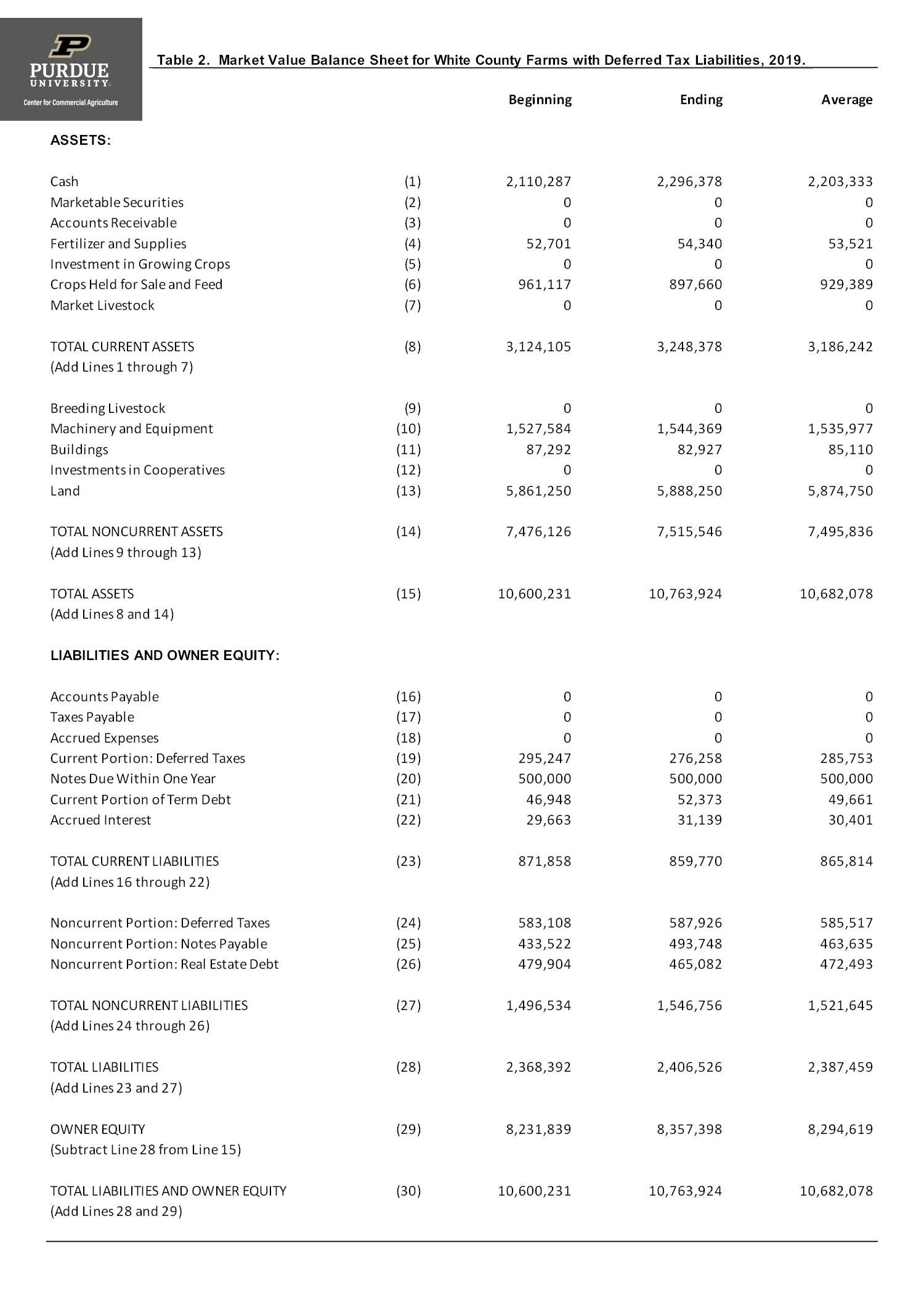

Computation Of Deferred Tax Liabilities Center For Commercial Agriculture

Accounting For Income Taxes Ppt Download

What Is A Deferred Tax Asset Definition Meaning Example

Deferred Tax An Overview Sciencedirect Topics

Answered Calculate The Deferred Tax Liability Bartleby

An Introduction To Asc 740 Tax Provisions Youtube

Deferred Tax Liabilities Meaning Example Causes And More

Deferred Tax Asset Journal Entry How To Recognize

Solved Accounts Receivable Inventories Buildings Net Provision For Warranty Unearned Rent Per Book P1 500 000 1 150 000 10 000 000 1 200 000 700 0 Course Hero

/Deferredtaxliability_fial_rev-aa7da3f65e644dfea5b55f8ca59f54e4.png)

Deferred Tax Liability Definition How It Works With Examples

/Deferredtaxliability_fial_rev-aa7da3f65e644dfea5b55f8ca59f54e4.png)

Deferred Tax Liability Definition How It Works With Examples